The purchase or rental of a vehicle requires thought. Will it be used for daily trips, to go away on holiday, to drive the kids to their various activities, to go to work in heavy traffic? All of these? Whatever the vehicle chosen, you now have to insure it. Some then go in search of a premium that respects their budget, others prefer the best coverage there is. In either case, everyone first seeks to avoid unpleasant surprises in the event of as incident. Gold Standard Insurance offers you peace of mind thanks to its expertise and will guide you towards the ideal solution that meets all of your needs.

Do you commute every day, or save your driving for weekends? Are you running errands or carpooling? There are many factors that could affect your premium, contact us today so we can make sure your insurance suits your current needs.

If you own a vehicle in Ontario, you’re required by law to purchase coverage in case an accident occurs. At a minimum you must carry:

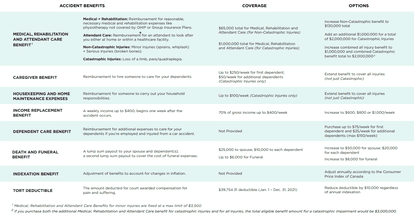

Effective June 1, 2016 Accident Benefits coverages included as part of your standard insurance policy has changed, accident benefits provides you (or in the case of death, your dependants) with mandatory benefits you're entitled to receive if you're injured or killed in a car accident, regardless of who's at fault. And, if you're looking to increase your Accident Benefits coverage, you have the option to purchase enhanced benefits to add to your standard policy. Here's a list of options you can consider: